I. Introduction

Gold jewelry has long been cherished for its beauty, rarity, and enduring value. For millennia, civilizations across the globe have adorned themselves with gold ornaments, recognizing not only their aesthetic appeal but also their significance as a form of wealth and status symbol. In today’s modern investment landscape, gold jewelry continues to hold a special place as a tangible asset that offers unique advantages for investors seeking to diversify their portfolios and preserve wealth.

II. Historical Significance of Gold

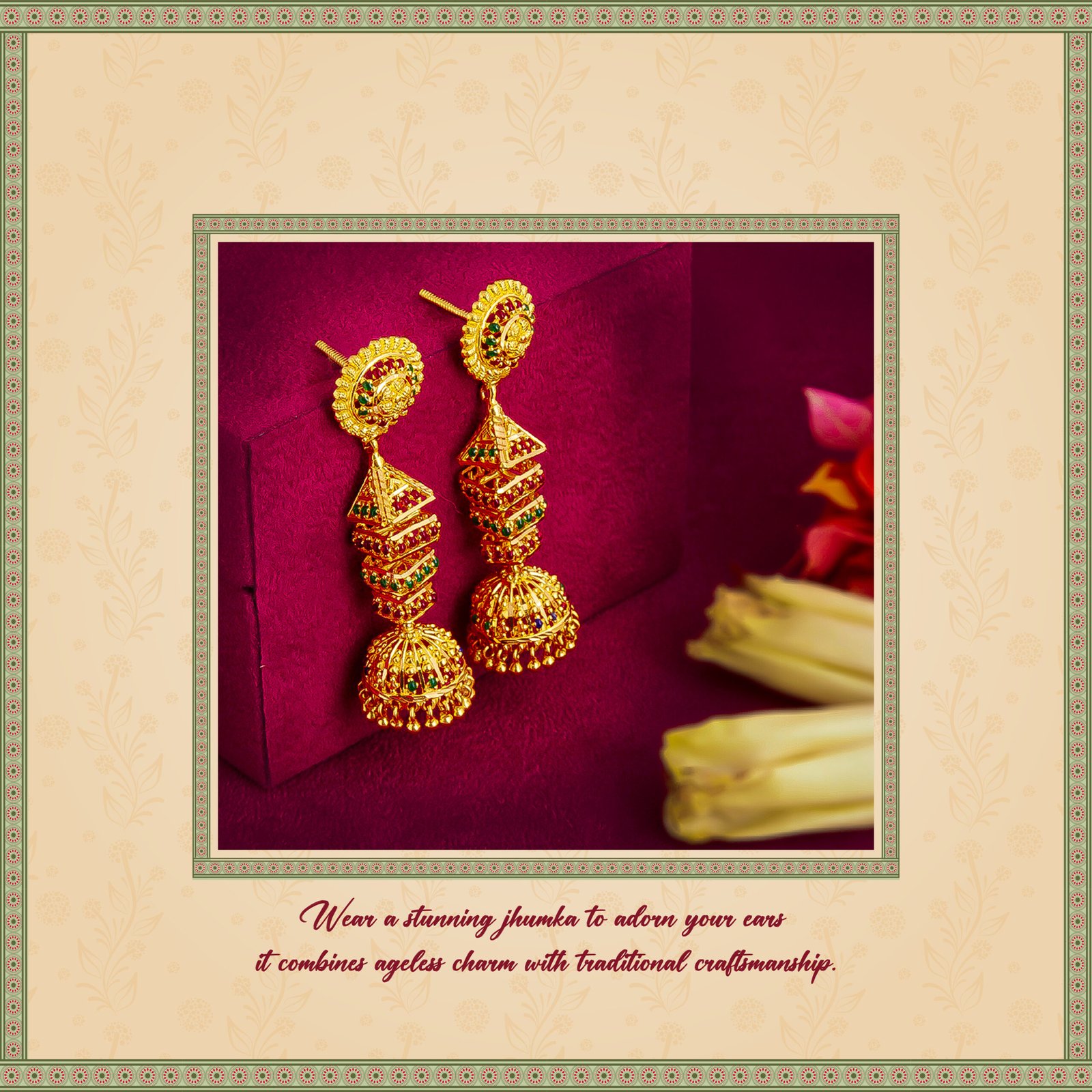

Throughout history, gold jewelry has been revered for its intrinsic value and cultural significance. From the ancient civilizations of Egypt and Mesopotamia to the opulent courts of Europe and Asia, gold jewelry has been worn by royalty, nobility, and commoners alike. Its enduring allure as a symbol of wealth and prosperity has transcended time and continues to be celebrated in various forms of adornment, from intricate necklaces and bracelets to elegant earrings and rings.

III. Tangible Asset

Unlike paper assets such as stocks and bonds, gold jewelry is a tangible asset that can be held, admired, and passed down through generations. Its physical presence provides a sense of security and stability, especially during times of economic uncertainty. As a form of portable wealth, gold jewelry offers investors the flexibility to easily buy, sell, or trade their holdings as needed, making it a valuable addition to any investment portfolio.

IV. Diversification Benefits

Diversification is a fundamental principle of investment strategy, and gold jewelry can play a crucial role in helping investors mitigate risk and achieve greater stability in their portfolios. By adding gold jewellery to a diversified mix of assets, investors can potentially reduce the overall volatility of their investments and protect against unforeseen market downturns or geopolitical events. As a non-correlated asset, gold jewellery tends to exhibit different price movements compared to traditional financial assets, making it an effective hedge against inflation and currency depreciation.

V. Preservation of Wealth

One of the most compelling reasons to invest in gold jewelry is its proven ability to preserve wealth over the long term. Unlike fiat currencies that can be devalued by central banks or governments, gold jewellery maintains its intrinsic value regardless of economic conditions. Throughout history, gold jewellery has served as a reliable store of wealth, providing a hedge against inflation and financial instability. In times of crisis, gold jewellery can be easily converted into cash or used as a form of barter, making it an indispensable asset for prudent investors seeking to safeguard their wealth against unforeseen risks.

VI. Liquidity and Accessibility

old jewelry offers investors unparalleled liquidity and accessibility, with a vibrant global market that spans continents and cultures. Whether buying, selling, or trading gold jewelry, investors have access to a wide range of channels and platforms, from local jewelers and pawnshops to online marketplaces and auction houses. Unlike other forms of gold investment such as bullion or ETFs, which may require specialized knowledge or infrastructure, gold jewelry is readily available to anyone with an interest in acquiring it, making it an attractive option for investors of all backgrounds and experience levels.

VII. Practical Considerations

When investing in gold jewelry, there are several practical considerations to keep in mind to ensure a successful investment experience. First and foremost, investors should carefully evaluate the quality and craftsmanship of the gold jewellery they are considering purchasing, paying close attention to factors such as purity, design, and brand reputation. Additionally, investors should consider the costs associated with storing and ensuring their gold jewellery holdings, as well as any tax implications that may arise from buying or selling gold jewellery.

VIII. Conclusion

In conclusion, gold jewelry represents a timeless investment opportunity that offers numerous benefits for investors seeking to diversify their portfolios and preserve wealth. With its intrinsic beauty, enduring value, and historical significance, gold jewellery continues to captivate the hearts and minds of people around the world. For those looking to add gold jewelry to their investment portfolios, Naraynadas Jewels stands as a trusted provider of exquisite gold jewellery pieces crafted with precision and passion. With a legacy of excellence spanning generations, Naraynadas Jewels offers investors the assurance of quality, authenticity, and enduring value in every piece of gold jewellery they acquire.

IX. Additional Resources

For more information on investing in gold jewelry and exploring the exquisite collection offered by Naraynadas Jewels, please visit their website or contact their knowledgeable team of experts for personalized assistance.